School should require financial literacy

Freshman Jaden Petersen spends his free time learning about finances. He finds them both interesting and vital to success later in life. Finances are seen in every aspect of adult life.

February 27, 2020

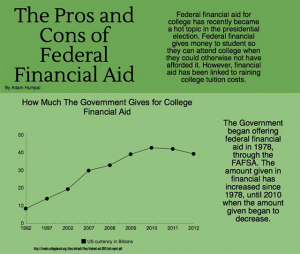

Financial literacy classes should be required if students are expected to lead an educated, financially independent life. Students statistically show a lack of knowledge in important subjects such as taxes, investing and debt. Personal finance classes are offered widely, but not required in more than half of states, including Minnesota. But students seem to be unwilling to take time out of the school day for this important subject.

Only 17 states require personal finance classes to be taken; Alabama, Arkansas, Arizona, Florida, Georgia, Idaho, Michigan, Missouri, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Tennessee, Texas, Utah and Virginia. This means that only 34 percent of America’s students are graduating high school with knowledge on how to become financially independent. Money touches every aspect of life, and having such a large population clueless about finances creates an archaic and difficult path to further the United States’ economic success.

Junior Schuyler Dupont shares this view and voiced her concern about her future without this vital knowledge, “Everyone has to know [finances], just like they need to know how to write and read. It’s essential for every day,” Dupont said. “I wouldn’t go out of the school day to [learn] this because we’re here to learn and this is when and where it should be taught.”

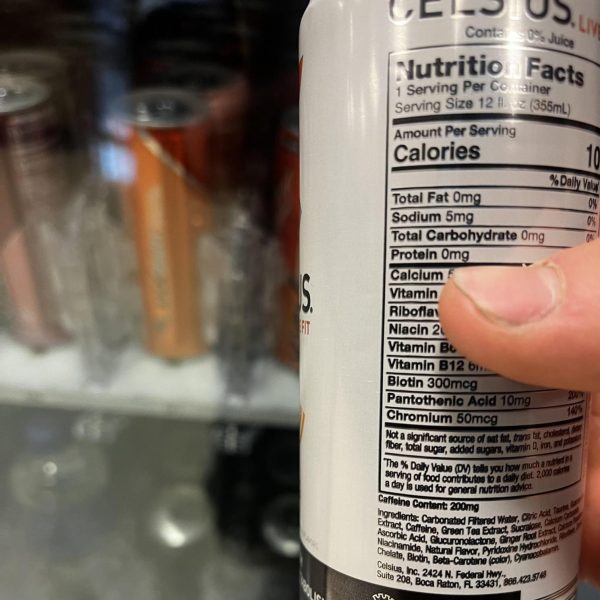

According to Liz Fraizer, writer for Forbes Magazine, the difference between being a financially knowledgable person and someone without this knowledge can be the difference between poverty and prosperity. Thirty eight percent of American households have credit card debt, a crippling debt with high interest rates and no increasing value. This is very different than student loans or mortgages, which are considered good kinds of debt because of low interest rates and the value they will generate over time. This 38 percent shows lack of education on how dangerous bad debt can become.

Not only do students think they need financial literacy classes, but teachers as well. Philip Schut, a personal finance and business teacher, said, “The majority of the students that I have had in Personal Finance have told me that it was one of the most useful and directly applicable courses that they have ever taken.”

The majority of the students that I have had in Personal Finance have told me that it was one of the most useful and directly applicable courses that they have ever taken.

— Philip Schut

He also talked about his touch with debt as a young adult and how he was able to have the discipline, the principal that most do not realize is so crucial with debt, and “dig (himself) back out of it.”

Not everyone is knowledgable before getting into financially troubling situations. With education in schools, this problem could be prevented entirely.

Interestingly, economic education interests change with demographics too. In higher income areas, students show more interest in investing and insurance. In less affluent areas, students are concerned with budgeting, taxes, banking and saving. In District 834, students have a concerningly low level knowledge of budgeting and use of credit.

Parent, Jessica Petersen, recognizes children need to be getting financial education from a reliable source, but believes it should be done in the home.

“I believe that children’s parents should teach them…but knowing that a lot of parents don’t teach them and a lot of parents aren’t good at managing money,” Petersen said.

Although there is some debate over where this education needs to come from, one verdict is unanimous, financial education needs to come from somewhere.

“We come here to learn…this would obviously be useable,” Dupont said.

Link to America’s 38% credit card debt information:

Elle Guggenberger • Mar 5, 2020 at 4:20 pm

I love that you got a parent’s perspective on this situation, it’s interesting to hear what a parent thinks about who should be teaching kids about finances. The quote from Petersen also addresses an alternative solution to teaching financial literacy in schools. Overall, the article is amazing and I strongly agree! Taking personal finance myself has been one of my best decisions in high school and your article covers a bunch of different reasons why others should take it as well, even if it isn’t required.