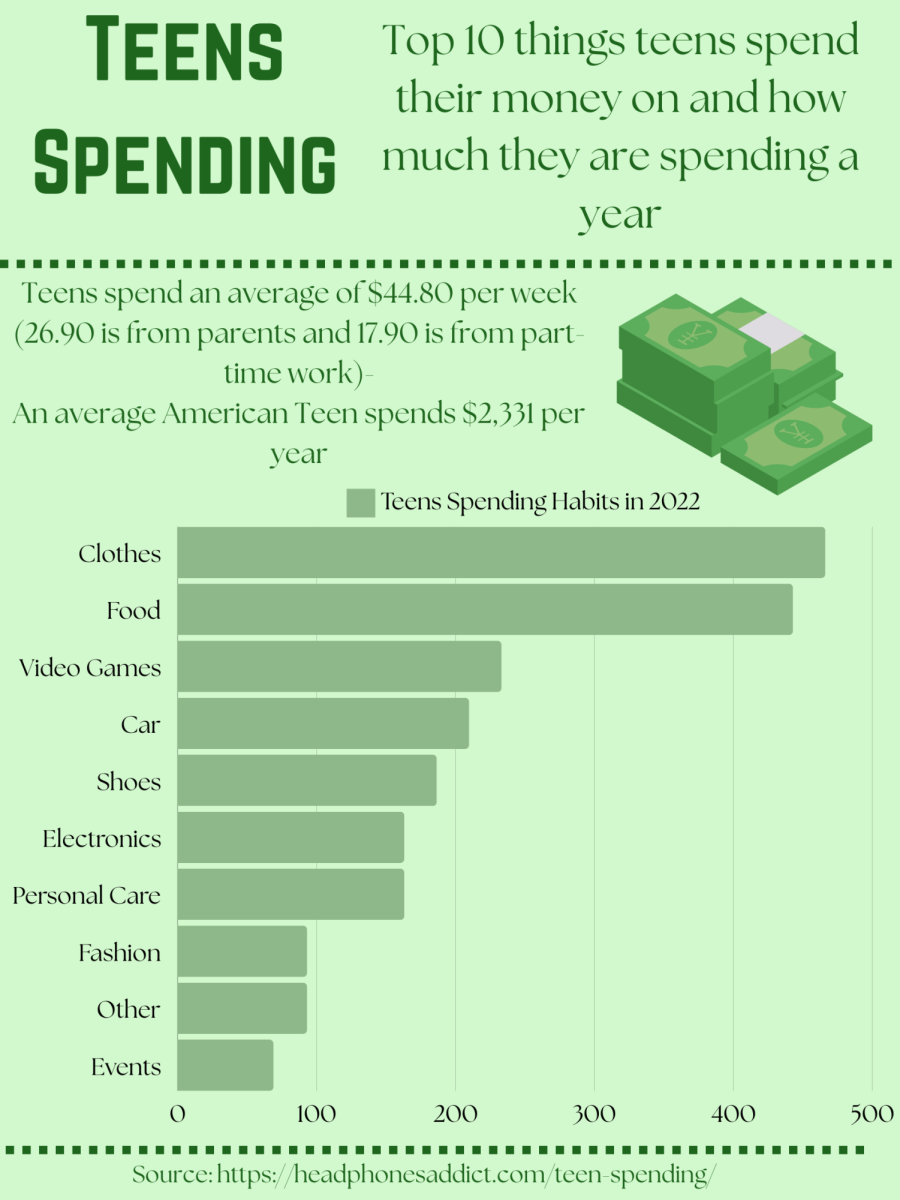

Most high school students have some form of part time job, working around 10-15 hours per week ranging from $9-16 per hour. Considering many have limited income, making decisions on what to buy can be difficult. Students have to weigh their options carefully, often deciding between short term enjoyment like purchasing fast food or saving for larger items.

When looking at data from a study from the University of Michigan, food is a top category that teenagers spend their paychecks on. For students, stopping and grabbing a meal with friends can be a good way to socialize after school hours. After school the majority of students find themselves spending money on an afternoon snack.

“I get food a lot and I hang out with my friends,” junior Luca Wieland explained.

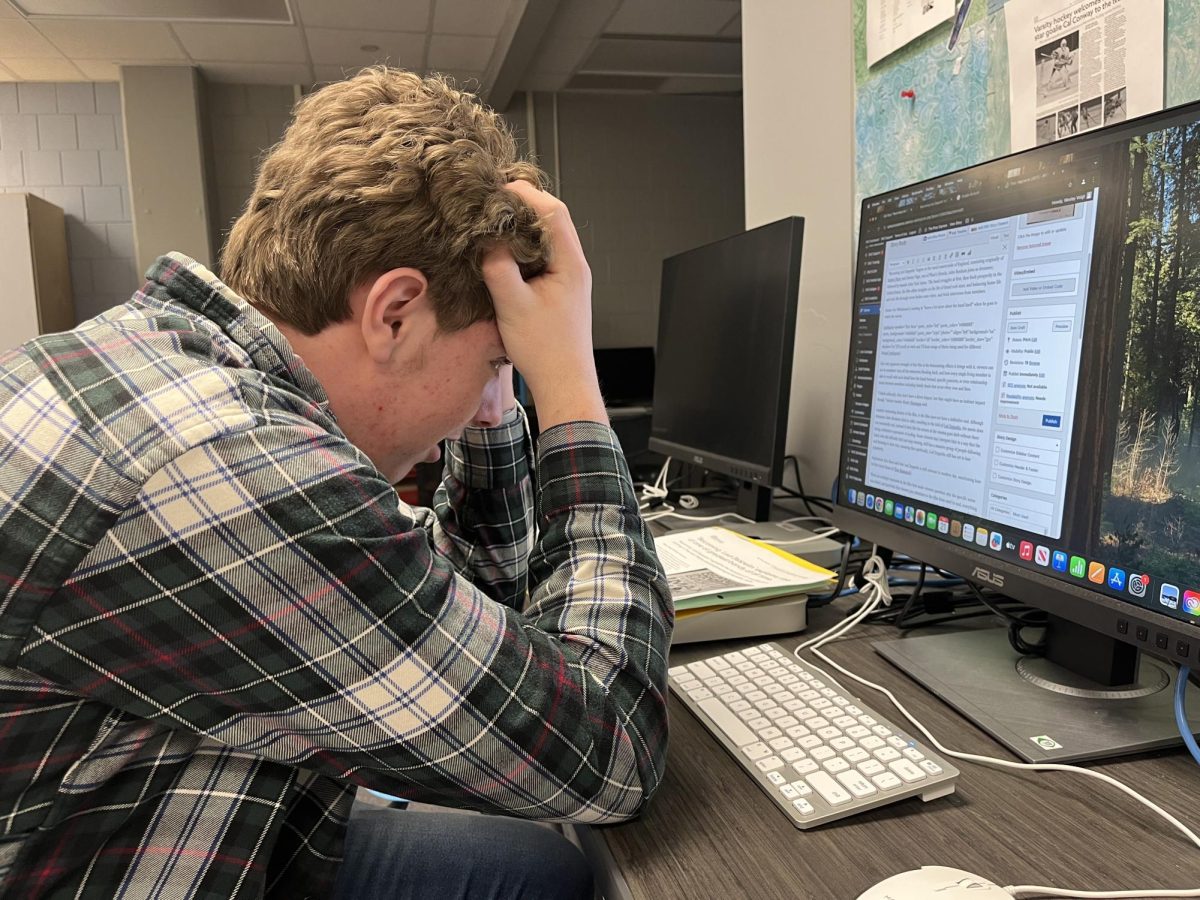

When budgeting money that teenagers get from their after school jobs, most find themselves spending more than they save. Small purchases can add up quickly over time. Most students opt for buying multiple small items rather than big ticket purchases.

Junior Sabrina Myhra said she spends most of her money from her after school job at Candyland downtown Stillwater on items like clothing and accessories. Although deciding what to save and what to spend can be tricky for some teenagers, “I save most of it, but I think I spend more than I should,” Myhra added.

Some high school students save a large percent of their income for bigger items they enjoy. Students feel their hard work pays off being able to purchase big ticket items.

Junior Kessler Bendar said he saves most of his money from his job working at the St. Croix Valley Recreation Center as well as working a summer job at the Stillwater River Boats. Bednar spends this money on rock climbing competition fees he justifies spending a large amount of money within a couple of months to be able to compete in competitions.

Along with saving money for large purchases some teenagers opt for saving for things like their future education or emergency funds. The majority of students put aside around 20% of their packcheck for their savings account. Wieland says that he puts aside “$200 to 300” into his savings account each pay day from his job at the Stillwater River Boats during the summer and working at the St. Croix Valley Recreation center during the winter.

Teenagers that do not have large expenses such as car payments or rent each month have more financial freedom to purchase things such as clothing or eating out. This makes deciding what to buy easier

“I don’t have a car and I don’t drive so I feel like its ok when I buy concert tickets that are really expensive like I’m not paying for gas, I’m not paying for things like an insurance bill on a car, until I have my own car I can buy things like concert tickets,” Myhra said.

To ease the stress of busy lives, teenagers spend their money on things that bring them joy. Deciding what is worth spending their money can be a difficult,decision but most students spend their checks on things like food, activities, sports and clothes. Spending money on small items often, as well as saving for bigger purchases, can be a way to de-stress however teenagers often struggle to find a balance between the two.