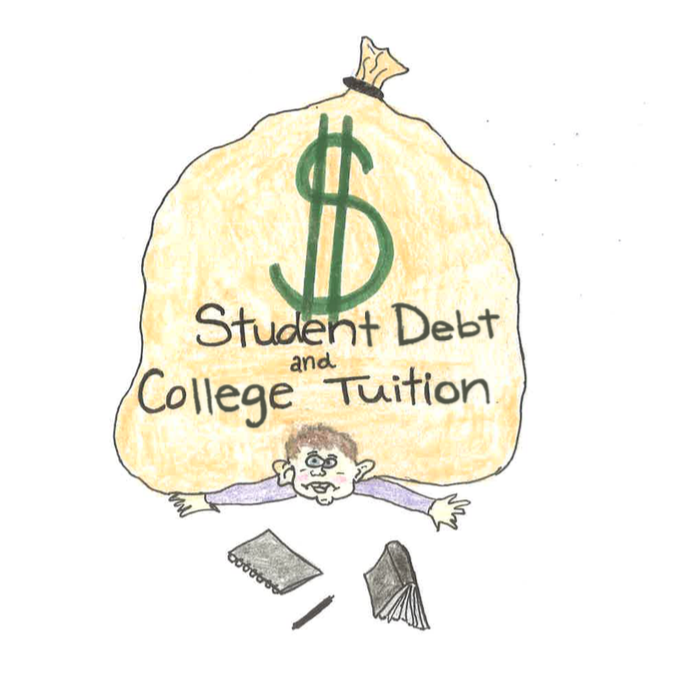

Unaffordable college puts students in a bind

Elementary school, middle school, high school, college: that is the most common, and encouraged, order of a students’ life. Though education through junior or senior year is required, everything a student learns is seemingly in preparation for college. College is treated as the most important part of education, and of success, but is made almost impossible to afford. Yet with skyrocketing tuition, students are still encouraged to take the college route versus other options.

When looking at the college tuition prices that parents and grandparents paid decades ago, high school graduates planning on attending college are bound to be jealous. College tuition prices have been on the rise for decades, and have become unaffordable for students, especially those working minimum wage jobs between classes and over the summer. In 1998, the federally mandated minimum wage was $5.15 (adjusted to around $7.80 for inflation), and now in 2018 it is $7.25, though in both situations it can vary by state, city, and county. In comparison, college tuition has skyrocketed in the same period of time, and colleges wages cannot keep up with rising expenses.

Back when my parents went to college, they were able to work a minimum wage job over the summer and be able to actually eat in college. I think the rate at which the price of college has increased doesn’t match the rate at which the minimum wage has increased.

— Kayta Harycki

“Back when my parents went to college, they were able to work a minimum wage job over the summer and be able to actually eat in college. I think the rate at which the price of college has increased doesn’t match the rate at which the minimum wage has increased,” senior Katya Harycki said.

The buying power of a dollar has gone down over the decades, and wages have been increased to try and balance out the difference. The cost of college tuition, however, has continued climbing passed a reasonable rate, even adjusted to inflation. The wages of most college students are not enough to pay for college and other necessities, whether they are making minimum wage or double that.

“I feel like all that [a college student salary] pays for is food expenses and not much else. People used to pay their way through college with those jobs and you can’t do that anymore because it cost so much,” senior Emma Ecker said.

College is treated as the only sensible option after high school, and has become the new high school diploma. It is difficult to find a job without a college degree, thus hard to become successful if a student chooses not to attend, or to do something else after high school.

Without a degree, it can be very difficult to find a job and make enough money to survive. It is seemingly necessary to attend college and obtain tens of thousands of dollars in loan debt, or more, to be hired for the job that will help to pay it off. In 1988, a student would pay on average $3,190, adjusted to reflect 2017 dollars, for one year in a four year public college. If college has become crucial for success, it should be made affordable for students, the way it was 30 years ago.

“It’s basically a necessity if you want to have a job that doesn’t pay minimum wage as an adult, it’s really hard if you don’t go to college and obtain and education. So it’s kind of like the new high school diploma, which is weird,” Ecker said.

Though many jobs should not require a college degree, jobs like doctors, lawyers, surgeons, and similar things should require extensive training and education outside of high school. The price of college is not justifiable in any situation, though, and education and training should be able to be obtained in ways other than a four year college trip.

If two thirds of someone’s life can be affected by having a college degree or not, it should be affordable. Students should not drown in loan debt to afford a college degree. Tuition prices need to be reduced, or college degrees need to become more optional again.

Lilly Sample, a senior, is an Online Editor-in-Chief for the Pony Express. Aside from working on the newspaper and Pony Express website, she volunteers...